Before you apply

You’ll need to provide additional information along with your application.

Written procedures

You must provide a document which details your Customs Procedures along with your application and this must include information on:

- your experience and qualifications in customs matters

- who will be responsible for making your declarations

- your management checks, showing how you’ll identify and report any errors found after you’ve submitted your final declaration

- document retention and security

If you have an Authorised Economic Operator authorisation for customs simplifications you do not need to give this information.

If you’re applying for imports, then you will also need to provide:

- month-end processes (for example, final supplementary declarations and late declaration estimates)

- if you’re applying to use aggregation, provide details of your aggregation procedures, how you will make sure the aggregated rules are complied with, and any management controls you undertake

- duty management system (DMS) procedures and how your DMS communicates with your commercial systems (if applicable)

If you’re applying for exports, then you’ll also need to provide information on your export procedures

Commodity codes

You must provide a description of the goods, either the relevant 8 digit Customs Nomenclature (CN) codes of the goods or the 4 digit chapters of the CN. The description of the goods must be the normal trade description and detailed enough for immediate, precise identification and classification.

For example, Import 090112 00 or Import 0901 Coffee – not roasted – decaffeinated.

The lists should be provided as spreadsheets.

Third-party applicants

If you’ll be acting as an indirect representative, you will not be able to use your own simplified procedure authorisation when making declarations to the following special procedures held by your clients:

Third-party applicants (imports only)

If you’re applying to make declarations as a third-party representative, you must provide a client list.

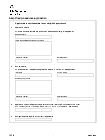

For each client you must provide:

If you do not have any clients, before you use your simplified procedure authorisation you will need to provide this.

Centralised clearance

If you’re applying for Centralised Clearance in Northern Ireland, you must provide a list of the other companies who will be involved in the centralised clearance authorisation.

You cannot apply for Centralised Clearance for imports into Great Britain (England, Scotland and Wales).

How to apply

Complete the C&E48 form to apply for authorisation to use simplified procedures for importing and exporting.

PDF, 763 KB, 10 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email different.format@hmrc.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

Email HMRC to ask for this form in Welsh (Cymraeg).

After you’ve applied

HMRC will write to you about your application.

If we authorise you, you’ll get a letter that:

You should write to the address on your letter if you want your authorisation to be:

You should also write to us if there has been a change to your business which may impact on your authorisation, such as, changing your name or being taken over by another business.

Before you apply

You’ll need to provide additional information along with your application.

Written procedures

You must provide a document which details your Customs Procedures along with your application and this must include information on:

- your experience and qualifications in customs matters

- who will be responsible for making your declarations

- your management checks, showing how you’ll identify and report any errors found after you’ve submitted your final declaration

- document retention and security

If you have an Authorised Economic Operator authorisation for customs simplifications you do not need to give this information.

If you’re applying for imports, then you will also need to provide:

- month-end processes (for example, final supplementary declarations and late declaration estimates)

- if you’re applying to use aggregation, provide details of your aggregation procedures, how you will make sure the aggregated rules are complied with, and any management controls you undertake

- duty management system (DMS) procedures and how your DMS communicates with your commercial systems (if applicable)

If you’re applying for exports, then you’ll also need to provide information on your export procedures

Commodity codes

You must provide a description of the goods, either the relevant 8 digit Customs Nomenclature (CN) codes of the goods or the 4 digit chapters of the CN. The description of the goods must be the normal trade description and detailed enough for immediate, precise identification and classification.

For example, Import 090112 00 or Import 0901 Coffee – not roasted – decaffeinated.

The lists should be provided as spreadsheets.

Third-party applicants

If you’ll be acting as an indirect representative, you will not be able to use your own simplified procedure authorisation when making declarations to the following special procedures held by your clients:

Third-party applicants (imports only)

If you’re applying to make declarations as a third-party representative, you must provide a client list.

For each client you must provide:

If you do not have any clients, before you use your simplified procedure authorisation you will need to provide this.

Centralised clearance

If you’re applying for Centralised Clearance in Northern Ireland, you must provide a list of the other companies who will be involved in the centralised clearance authorisation.

You cannot apply for Centralised Clearance for imports into Great Britain (England, Scotland and Wales).

How to apply

Complete the C&E48 form to apply for authorisation to use simplified procedures for importing and exporting.

PDF, 763 KB, 10 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email different.format@hmrc.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

Email HMRC to ask for this form in Welsh (Cymraeg).

After you’ve applied

HMRC will write to you about your application.

If we authorise you, you’ll get a letter that:

You should write to the address on your letter if you want your authorisation to be:

You should also write to us if there has been a change to your business which may impact on your authorisation, such as, changing your name or being taken over by another business.