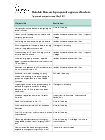

| [5] |

In the cases where Article 166(2) of the Code (simplified declarations based on authorisations) is applicable, Member States may waive the obligation to provide this information where the conditions prescribed in the authorisations associated with the procedures concerned allow them to defer the collection of this data element in the supplementary declaration. |

| [7] |

Enter any Union or National codes which apply to the Procedure or Commodity code – see the appropriate Appendix contained in UK Trade Tariff, Volume 2 or UK Trade Tariff, CDS Volume 3 |

| [7a] |

This data element is mandatory where an Additional Information (AI) statement is required |

| [7b] |

This data element must be completed when an authorisation or document is required to release the goods from the border |

| [9] |

This information needs to be provided only where Article 166(2) of the Code (simplified declarations based on authorisations) is applicable; in this case, it is the number of the authorisation for simplified procedure. |

| [11] |

This information is mandatory when a declaration is made to enter to or discharge from Customs/Excise warehousing procedure or free zone |

| [11a] |

This data element is only required when the Previous Procedure Code declared in DE 1/10 includes the codes ‘07’ or ‘71’. |

| [11b] |

This information is mandatory when goods are being entered to a customs warehouse or discharged from a free zone |

| [11c] |

This information is mandatory when goods are being removed from a customs warehouse or free zone |

| [12] |

This information is mandatory where the EORI number of the person concerned is not provided |

| [12a] |

This data element is mandatory unless covered by a specific exemption, please refer to the Procedure Code, Additional Procedure Code and Declaration Completion Guide for details. |

| [12b] |

This information is mandatory but only requires completion if the entity is different to that declared in DE 3/18 or DE 3/41 |

| [12c] |

Where self-representation is used, this data element should be left blank |

| [12d] |

This information only requires completion if the entity is different to that declared in DE 3/1 or 3/2 |

| [12e] |

This information is mandatory but only requires completion if the entity is different to that declared in DE 3/15 or 3/16 |

| [12f] |

This is only mandatory where an authorisation is required to declare the goods to a specific customs procedure.

This data element does not require completion where: 1) an authorisation by customs declaration for a special procedure, 2) Simplified Procedures (on an occasional basis) are used or 3) where an oral declaration is used. |

| [12g] |

Mandatory where a recognised Identification number is held or where DE 3/1 is not completed |

| [12h] |

Mandatory where a recognised Identification number is held or where DE 3/9 is not completed |

| [12i] |

Mandatory where a recognised Identification number is held or where DE 3/31 is not completed |

| [12j] |

Mandatory except for procedure codes 0007, 0008 and 0009 |

| [12k] |

This data element should not be completed for Procedure codes 0008, 0009, 0018 or 0019 |

| [12l] |

This data element is not required where the Procedure code is 0009 or 0019 |

| [12m] |

This data element is mandatory in all cases unless DE 3/41 has been completed. If DE 3/41 has been completed this data element should be left blank. |

| [12n] |

This data element is not required for Procedure Code 0008 or 0018. |

| [12o] |

This Data Element is not required for 00 09 or 0019 |

| [12p] |

This data element is only required for Procedure Code 0007 where EIDR is used. In these circumstances, DE 3/18 must be left blank. |

| [12q] |

This data element must be completed with the EORI no. of the MoU operator |

| [12r] |

This data element may not be used with self-representation |

| [12s] |

This data element is optional in GB |

| [16] |

Mandatory where valuation Method 1 is used |

| [18] |

This information is mandatory unless the goods are eligible for relief from import duties and other charges |

| [18a] |

Only mandatory when the Procedure or Commodity code require additional information to apportion licences or other documents, for example number of litres exported |

| [18b] |

Only requires completion where there is a manual tax calculation being made |

| [18c] |

Only required where revenue has to be paid or secured prior to release of the goods |

| [18d] |

Only required when goods are being released using EIDR

|

| [18e] |

Only required for procedure codes where a document/licence/certificate has to be endorsed using the C21e |

| [20] |

This information is mandatory where it is essential for the correct determination of the customs value |

| [20a] |

Where delivery terms are declared in DE 4/1 that require an addition or deduction to the customs value, the equivalent addition or deduction code must be declared in DE 4/9 to prevent the declaration being rejected. |

| [21] |

This information shall only be provided if the customs duty is calculated in accordance with Article 86(3) of the Code |

| [22] |

Member States may require this information only in cases when the rate of exchange is fixed in advance by a contract between the parties concerned. |

| [23] |

For completion only where Union legislation so provides |

| [25] |

This information shall only be required where the simplified declaration is not lodged together with an exit summary declaration. |

| [28] |

This information is only required where no preferential treatment is applied; or the country of non-preferential origin is different to the country of preferential origin |

| [29] |

This information is only required where a preferential treatment is applied using the appropriate code in DE 4/17 – Preference |

| [29a] |

Completion only required where a deduction of air transport costs is being claimed |

| [30] |

This information shall only be required when centralised clearance/SASP is being used |

| [31] |

This data element is only to be completed as required by the Declaration Completion Guide, Procedure Code or Additional Procedure Code completion notes |

| [31a] |

Only required if specified by the Commodity code |

| [31b] |

Only requires completion when releasing part of a bulk consignment |

| [31c] |

Completion is not required if a declaration is being made to Temporary Admission |

| [31d] |

Completion is only required where this is stipulated in the Customs Warehousing authorisation |

| [31e] |

This data element is only required where a UN dangerous goods code applies |

| [31f] |

This data element is mandatory where the goods are being VAT zero-rated for export |

| [31g] |

VAT zero-rating details should be completed, where appropriate on the supplementary declaration. |

| [32] |

This information shall only be required in case of commercial transactions involving at least two Member States |

| [41] |

This data element is only required where the import formalities are not carried out at the point of entry into the customs territory of the Union. |

| [41a] |

This data element is mandatory when the goods are declared for export using EIDR, CSE, at a DEP, or at a Customs or Excise Warehouse. |

| [43] |

This data element is not required where codes 5 (Postal) or 7 (Fixed Energy Installations) have been declared in DE 7/4. |

| [43a] |

Only requires completion when goods are containerised |

| [46] |

This data element is not required where codes 2 (Rail), 5 (Postal) or 7 (Fixed Energy Installation) have been declared in DE 7/4 |

| [46a] |

Only required where a claim to quota is being made |

| [46b] |

Only required where the customs declaration covers controlled goods.

Where controlled goods are declared, all items on the declaration will be required to comply with the controlled goods data set. To avoid having to provide additional data for controlled goods, you may wish to declare any non-controlled goods on a separate declaration. |

| [46c] |

Completion of this data element is only required when a claim to a critical quota is being made |

| [46d] |

Where controlled goods are using SIV or SPV values and are also declaring E01 or E02 in DE 1/11, this DE should be left blank |

| [49] |

Only required where the Procedure code or Method of Payment (MOP) dictates completion |

| [49a] |

Only to be completed where a guarantee is required to release the goods, or a Cash Account is being used to pay or secure the charges |

| [50] |

To be completed in accordance with the requirements of DE 8/6 Declaration Completion Guide and DE 1/10 completion notes. |

| [50a] |

This only requires completion where there is no sales contract for the goods |

| [50b] |

This data element is mandatory unless otherwise specified in the DE 1/11 Additional Procedure Code |

| [51] |

This data element must be completed where details are known |

| [53] |

This data element is not required on a supplementary declaration |

| [53a] |

This data element is only required on simplified declarations with a value of €1,000 or above |

| [54] |

This data element is only mandatory for invoices of £100,000 and above |

| [56] |

Only required on an EXS customs clearance request |

| [57] |

Unless specified in the DE 1/10 Procedure Code notes, types B and E may not be used. |

| [58] |

Unless specified in the DE 1/11 Procedure Code notes, types B and E may not be used. |

| [59] |

Licensable goods may only be declared using a B or E data set by a public body.

One of the following Additional Procedure Codes 1MO, 2MO or 0GD must be declared in DE 1/11. |

| [59a] |

Licensable goods may not be declared using a B or E data set |

| [60] |

Only codes 100 or 118 may be declared in this data element. |

| [61] |

This data element is only required when the Method of Payment is Cash Account or General Guarantee Account. |

| [63] |

Guarantee details are not required for special procedures at the simplified declaration stage |

| [64] |

Only for express consignments |

| [65] |

This data element is only required on a combined EXS and pre- departure declaration. |

| [66] |

This data element only requires completion where the Carrier differs from the Declarant declared in DE 3/18 |

| [67] |

This data element is only required where the requested or previous procedure declared in DE 1/10 is 42 Onward Supply Relief (OSR) |

| [67a] |

VATZ must not be declared in DE 6/17 |

| [67b] |

This data element must be completed at header level when Postponed VAT Accounting (PVA) is being used |

| [67c] |

This data element must be completed at item level when Onward Supply Relief (OSR) is being used |

| [67d] |

Buyer details must be completed when a tax representative is being used for Onward Supply Relief (OSR) |

| [68] |

This data element requires completion for goods subject to an electronic licence. |

| [68a] |

This data element is only required where a document, licence or admissibility certificate has to be endorsed using the C21i |

| [69] |

Express consignments only:

Only the country of final destination for the goods should be provided |

| [70] |

This data element is only required for goods moving under excise duty suspense. |

| [71] |

This data element is mandatory if the movement is an indirect (re)export |

| [72] |

This data element is optional for postal consignments |