1. Overview

1.1 This notice

This notice explains:

- the VAT liability of goods and services provided by registered health, medical and paramedical professionals, including the VAT liability of drugs, medicines and other goods available on prescription, as well as contraceptives and smoking cessation products

- the circumstances in which VAT-registered health professionals may recover the VAT they have incurred on purchases and overheads

- specific rules that apply to supplies made by dentists, overseas medical practitioners and deputising doctors

- the circumstances in which care services provided by non-health registered suppliers are VAT exempt

- the VAT liability of supplies of health professional staff

For details of supplies made by hospitals, hospices, pathology laboratories or other state-regulated institutions providing healthcare, read Health institutions supplies (VAT Notice 701/31).

For details of the VAT relief for goods and services provided to disabled persons, read Reliefs from VAT for disabled and older people (VAT Notice 701/7).

1.2 Changes to this notice

EEA health professionals have been included in the list of relevant practitioners at paragraph 3.2.3 with effect from 1 April 2020.

1.3 Who should read this notice

You should read this notice if you’re:

- a registered health professional

- a care provider who is not enrolled on any register of medical or health professionals

- an employment business that’s providing care staff to hospitals or similar healthcare institutions

1.4 The law

This notice covers the following areas of the VAT Act 1994:

- exemption for services performed or directly supervised by certain registered medical and health professionals, set out in Schedule 9, Group 7, Items 1 to 3

- exemption for the services of a deputising doctor, set out in Schedule 9, Group 7, Item 5

- zero rating for qualifying goods dispensed to an individual for their personal use on the prescription of an appropriate practitioner dispensed by a registered pharmacist, or in accordance with a requirement or authorisation under a relevant provision, set out in Schedule 8, Group 12, Item 1 – see section 3

2. Medical services provided by registered health professionals

2.1 Meaning of a health professional

By ‘health professional’, we mean the following professionals when they’re enrolled or registered on the appropriate statutory register:

- medical practitioners

- optometrists and dispensing opticians

- professionals registered under the Health Professions Order 2001 – these professionals are:

- arts therapists

- biomedical scientists

- chiropodists or podiatrists

- clinical scientists

- dietitians

- hearing aid dispensers

- occupational therapists

- operating department practitioners

- orthoptists

- paramedics

- physiotherapists

- practitioner psychologists

- prosthetists and orthotists

- radiographers

- speech and language therapists

- any medical care professionals added to the Order (to be included at a future date)

- osteopaths

- chiropractors

- nurses, midwives and health visitors

- dentists, dental hygienists, dental therapists, dental nurses, clinical dental technicians, dental technicians and orthodontic therapists

- pharmacists

2.2 Exempting supplies if you’re a therapist who is not registered or enrolled under any statutory register

Therapists such as acupuncturists, psychotherapists, hypnotherapists and others who do not have statutory registers as described in paragraph 2.1 cannot currently exempt their services.

The UK’s approach of linking exemption to statutory registration is considered to be a sensible, objective criterion for defining ‘health professionals’ for VAT purposes, and is consistent with EU law.

2.3 The definition of medical services and which services performed by health professionals are exempt from VAT

If you’re a health professional as detailed in paragraph 2.1, your services are exempt when both of the following conditions are met:

-

The services are within the profession in which you’re registered to practice.

-

The primary purpose of the services is the protection, maintenance or restoration of the health of the person concerned.

For the purposes of VAT, medical services (including medical care and treatment) are restricted only to services which fulfil condition 2. This includes the diagnosis of illnesses, the provision of analyses of scans or samples and helping a health professional, hospital or similar institution to make a diagnosis.

The following are examples of services which we accept are for the primary purpose of protecting, maintaining or restoring a person’s health:

- health services provided under General Medical Services (GMS), Personal Medical Services, Alternative Provider Medical Services, General Dental Services and Personal Dental Services

contracts - sight testing and prescribing by opticians (only in England, Wales and Northern Ireland)

- primary eye examinations and secondary eye examinations (only in Scotland)

- enhanced eye health services

- laser eye surgery

- hearing tests

- treatment provided by osteopaths and chiropractors

- nursing care provided in a patient’s own home

- pharmaceutical advice

- services involving the diagnosis of an illness or the provision of analyses of samples forming an important part of a diagnosis

Certain insurance or education related services may also be exempt regardless of purpose, as they may qualify under other, independent, exemptions.

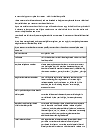

2.4 Services performed by health professionals that may be taxable or exempt

Following from condition 2 in paragraph 2.3 some services will be taxable or exempt, depending on their primary purpose. This is particularly the case in the area of medical reports and certificates, and in these cases, it’s necessary to establish their principal purpose, before liability can be determined.

Where the service is principally aimed at the protection, maintenance or restoration of health of the person concerned, the supply is exempt. However, where a medical report is done solely to provide a third party with a necessary element for taking a decision for insurance or legal purposes, the supply is taxable at the standard rate. Detailed examples are given in section 4.

2.5 Services that are not exempt from VAT

The following services are taxable at the standard rate:

- health services not performed by an appropriately qualified and registered health professional, except when either directly supervised by such a person or provided within a hospital or within other state-regulated institutions providing healthcare, this is explained further in section 5

- services not aimed at the prevention, diagnosis, treatment or cure of a disease or health disorder, such as paternity testing and the writing of articles for journals

- services directly supervised by a pharmacist

- general administrative services such as countersigning passport applications and providing character references

- supplies of health professional staff, except where they’re treated as being exempt from VAT under the nursing agencies’ concession, this is explained further in section 6

This list is not exhaustive. If you supply any of these services, you may be required to register for VAT, Notice 700/1: should I be registered for VAT? explains the rules relating to registration.

2.6 Qualifying for exemption if you’re a health professional conducting clinical trials

Your supply will only be exempt if it involves patient care, for example, where you’re required to monitor a patient involved in the trial for adverse reactions which may be detrimental to their health.

If your involvement with the patient is restricted to monitoring side-effects for analytical purposes, or if you provide analytical testing services which do not relate to an individual patient, this service is standard-rated.

3. Pharmaceutical goods supplied with or without medical treatment

3.1 Accounting for VAT on goods supplied in connection with VAT exempt medical treatment

If you provide medical treatment that is exempt from VAT, any charge that you make for bandages, drugs, medicines or prostheses, administered or applied to your patient in the course of the treatment is also exempt.

Any items that are separable from the treatment (such as privately dispensed drugs supplied for self administration by a patient, for example, for overseas travel purposes) are not exempt from VAT, and will usually be standard-rated. However, see paragraphs 3.3 and 3.4 for supplies of contraceptive and smoking cessation products. The supply of drugs, medicines and other items to patients by a pharmacist or doctor is zero-rated in certain circumstances – see paragraph 3.2.

3.2 Goods being provided on prescription being zero-rated for VAT purposes

The supply of drugs, medicines and other items for personal use of patients can be zero-rated only if all the following conditions are met:

- the supply must be of ‘qualifying goods’ – see paragraph 3.2.1

- the goods must be dispensed to an individual for that individual’s personal use

- the goods must not be supplied for use for patients while in hospital or in a similar institution or administered, injected or applied by health professionals to their patients in the course of medical treatment

- the goods must be dispensed by a registered pharmacist or under a requirement or authorisation under a ‘relevant provision’ – see paragraph 3.2.2

- the goods must be prescribed by an appropriate ‘relevant practitioner’ – see paragraph 3.2.3

3.2.1 Meaning of qualifying goods

These are any goods designed or adapted for use with any medical or surgical treatment except for hearing aids, dentures, spectacles and contact lenses.

3.2.2 Meaning of dispensed under a requirement or authorisation under a ‘relevant provision’

The relevant provisions are:

- article 57 of the Health and Personal Social Services (Northern Ireland) Order 1972

- regulation 20 of the National Health Service (Pharmaceutical Services) Regulations 1992

- regulation 12 of the Pharmaceutical Services Regulations (Northern Ireland) 1997

- paragraph 44 of Schedule 5 to the National Health Service (General Medical Services Contracts) (Scotland) Regulations 2004

- paragraph 15 of Schedule 1 to the National Health Service (Primary Medical Services Section 17C Agreements) (Scotland) Regulations 2004

- (paragraphs 47 and 49 of Schedule 6 to the National Health Service (General Medical Services Contracts) Regulations 2004

- paragraph 44 of Schedule 5 to the Health and Personal Social Services (General Medical Services Contracts) Regulations (Northern Ireland) 2004

- paragraphs 46, 48 and 49 of Schedule 5 to the National Health Service (Personal Medical Services Agreements) Regulations 2004

- paragraph 47 of Schedule 6 to the National Health Service (General Medical Services Contracts) (Wales) Regulations 2004

- regulation 60 of the National Health Service (Pharmaceutical Services) Regulations 2005

3.2.3 Meaning of ‘relevant practitioners’

By ‘relevant practitioners’, we mean the registered medical practitioners and dentists registered in the dentists’ register under the Dentists Act 1984.

Relevant practitioners also include:

- community practitioner nurse prescribers

- nurse independent prescribers

- optometrists

- independent prescribers

- pharmacist independent prescribers

- physiotherapist independent prescribers

- podiatrist independent prescribers

- supplementary prescribers, as defined in article 1(2) of the Prescription Only Medicines (Human Use) Order 1997(a)

The extension of the zero-rate under the conditions of paragraph 3.2 to qualified prescribers practicing within countries in the EEA (including Switzerland) applied from 1 April 2020. The list of approved providers and countries that applied from 1 January 2021 is now available.

A full list of EEA countries is listed here

More information on the supply of drugs and so on, by general practitioners (GPs) can be found at paragraph 7.4 and by pharmacists at section 11.

The EEA stands for the European Economic Area plus Switzerland.

3.3 Contraceptive products

Contraceptives prescribed and dispensed in line with the provisions of paragraph 3.2 are zero-rated. Contraceptives that are fitted injected or implanted by a health professional form part of a VAT exempt supply of medical care.

The reduced rate of VAT applies to all other supplies of contraceptive products – including sales by retailers, vending machines or via the internet – regardless of whether purchased by an individual or organisation such as a sexual health charity or the National Health Service (NHS).

The VAT treatment of fertility monitoring devices or any product used for natural family planning is not subject to the reduced rate.

3.4 Smoking cessation products

Smoking cessation products prescribed and dispensed in accordance with the provisions of paragraph 3.2 are zero-rated. The reduced rate applies to all other supplies of pharmaceutical smoking cessation products, including supplies made over the internet. This includes all non-prescribed sales of:

- patches

- gums

- inhalators

- other pharmaceutical products held out for sale for the primary purpose of helping people to quit smoking

3.5 Personal protective equipment (PPE)

A temporary zero rate was in effect from 1 May until 31 October 2020. This was for the supply to any business or individual of PPE as recommended by Public Health England on 24 April 2020, for use for protection from infection with coronavirus (COVID-19). Find information about VAT zero rating for PPE.

From 1 November 2020 the VAT treatment for supplies of PPE reverted back to the standard rate.

4. Liability of specific services provided by health professionals

Doctors provide a number of services which are also carried out by other registered health professionals, such as occupational health. To avoid duplication, in the services described, ‘doctor’ also refers to other registered health professionals, where appropriate.

4.1 Access to medical records

In certain circumstances individual patients or their representatives are entitled, by law, to ask for access to or copies of health records (including hand-written clinical notes, copies of letters to and from other health professionals, laboratory reports, X-rays, other imaging records and printouts from monitoring equipment) or medical reports written about them.

Data Protection Act 1998 – requests for copies of personal data are termed ‘Subject Access Requests’ (SAR). Where the holder of the records receives a SAR they’re obliged to provide the information requested, but may make a charge for so doing. The maximum amount of the fee is set by Regulation, and is a nominal sum to cover the expense of complying with the legal obligation to give access.

Access to Medical Reports Act 1988 – this Act governs access to medical reports made by the person’s own GP for insurance or employment purposes. The patient is entitled to ask for a copy of the report and, where such a request is made, the GP must provide one but can charge a reasonable fee to cover their costs incurred in so doing.

Access to Health Records Act 1990 and Access to Health Records (Northern Ireland) Order 1993 – these pieces of legislation facilitate access to the health records of deceased persons only by that individual’s personal representative and anyone with a claim arising out of the person’s death. The holder of those records is legally required to provide copies of records requested under this legislation. They may charge a fee for so doing, but it must not exceed the cost of making and mailing the copy to the applicant. Access to the health records of living persons will be made under the Data Protection Act 1998.

Where a doctor provides a copy of all or part of a medical record or report under the terms of one of the four statutory requirements set out, that activity is outside the scope of VAT.

Where a copy of a health record is provided in circumstances that do not fall within one of these statutory obligations, that is a taxable supply, and liable to VAT at the standard-rate.

See also statutory services under paragraph 4.13.

4.2 Certificates and reports

Most supplies of certificates and reports are liable to VAT at the standard rate as they allow a third party to make a decision and contain no element of therapeutic care. For example, they may let claims to compensation, benefits or registration as a blind or disabled person, which themselves give entitlement to certain services. However, where the principal purpose of certificates and reports is to protect, maintain or restore the health of the individual, then they’re exempt – for example, sick notes and certain reports required as part of adoption procedures.

Where fitness certificates are provided as a condition of a person taking up a particular profession or sporting activity, they’re taxable at the standard rate. However, where they’re provided to, for example, an employer for the purpose of ensuring that the employer recognises that the individual’s health places limitations on certain activities (for example, they should not undertake heavy lifting due to a severe back problem), then the purpose of the supply is principally to protect the health of the individual and is exempt.

Doctors may also provide reports under the ‘exercise on prescription’ scheme. This is a scheme funded by the NHS under which gym membership is provided free to certain defined patients with certain defined illnesses as part of the patient’s rehabilitation. As these supplies are aimed at restoring the health of the individual concerned, such reports are exempt.

4.3 Psychologists’ services

With effect from 1 July 2009 practitioner psychologists became regulated by the Health Professionals Council, meaning that any supplies of medical care they make became exempt from VAT from that date. Practitioner psychologists come under 7 domains: clinical, counselling, educational, forensic, health, occupational, and sport or exercise. Psychologists who work purely in academic research and experimental psychology and who do not offer services to the general public are excluded from regulation, meaning that there’s no change in the VAT treatment of their services.

‘Medical care’ means any service relating to the protection, maintenance or restoration of the mental health of the person concerned. Medical care includes services such as counselling, working with children with emotional problems, dealing with criminals’ behavioural problems or running stress management courses. It does not include supplies of time management services, which are not related to the mental health of the client.

4.4 Cosmetic services

Each case will need to be considered on its individual merits. However, we will generally accept that cosmetic services are exempt where they’re undertaken as an element of a health care treatment programme. Where services are undertaken purely for cosmetic reasons, they will be standard-rated. For services undertaken by hospitals and state-regulated institutions, see Health institutions supplies (VAT Notice 701/31).

4.5 Education services

Doctors undertake a wide variety of education-related activities and consideration should be given to whether they qualify as an exempt supply of education, see Education and vocational training (VAT Notice 701/30) before considering whether they qualify as a supply of exempt healthcare.

Lectures (be they one-off or a series) given as part of a medical training course or Continuing Professional Development and training sessions to first aiders, which are provided by a doctor in either a sole proprietor or partnership capacity, are exempt as a supply of private tuition under the education exemption.

Presentations aimed at promoting health are also considered to be exempt as their principal purpose is to protect the health of the individuals attending. However, presentations given to a non-medical audience on, for example, the latest medical developments are considered to be taxable.

4.6 Family planning and fertility services

This covers such services as counselling, contraception and sterilisation (and reversals), as well as In Vitro Fertilisation (IVF) treatment all of which we accept as being for the principal purpose of protecting the health of the person concerned and therefore exempt.

4.7 Forensic physicians

When forensic physicians are employed by the Home Office their services are outside the scope of VAT. However, when forensic services are undertaken as and when required by local doctors on a fees basis, we accept that such services are exempt healthcare, as they’re primarily concerned with the health of the victims or perpetrators of crime. If a statement or report is required at a later stage, this will be a separate supply which is liable to VAT at the standard rate.

4.8 Insurance services

Medicals and reports are requested by insurance companies for a broad range of insurance purposes. Some services, whilst forming a mandatory condition of the policy once accepted, have a therapeutic purpose and we accept that the following medical services commissioned by insurance companies meet the purpose test and qualify as an exempt supply of health in principle:

- health screening under private medical insurance policies – these are regular check-ups to detect early signs of disease

- income or credit protection insurance – medical services where the policy holder has fallen ill (as opposed to losing his job) and which are aimed at assisting the individual in returning to a normal life

- motor insurance – where medicals services are provided under a policy to assist in enabling an injured motorist to return to full health (or work) – this does not include medicals undertaken for Driver and Vehicle Licensing Agency purposes to make sure initial or continued fitness to drive which are liable to VAT at the standard rate

- any other medical service provided in connection with an insurance policy where the principal aim is to assist in restoring the health of the individual

In addition, when medicals and reports are provided in connection with the bringing together of parties to a contract of insurance, the administration of policies or the handling of insurance claims under such contracts, these services are currently exempt as insurance related services under the insurance exemption – see Insurance (VAT Notice 701/36).

Medicals and reports provided purely for the purposes of valuing policies for tax reasons, for example, in relation to Inheritance Tax, are liable to VAT at the standard rate.

Rehabilitation services are dealt with separately at paragraph 4.12.

4.9 Medico-legal work

This includes work performed by doctors such as medicals, reports and expert witness testimony for the judicial system and is considered to be liable to VAT at the standard rate. This is the case even where the services supplied are for the purpose of the family courts and where the ultimate decision arrived at by the court may concern the well-being of an individual. This is because the principal purpose of the services supplied is to let the court to take a decision.

Medical evidence services which are outsourced administrative services, such as arranging the provision of expert witnesses and obtaining medical reports, are also liable to VAT at the standard rate.

4.10 Mental health tribunals

These are to let a panel of registered health professionals to determine whether a person should commence or continue being detained under the Mental Health Act. As the purpose of the detention is to assess and treat the condition and is focused on helping people who are ill, but whose consent to treatment could not otherwise be obtained, we accept that services provided by way of the preliminary examination, observations and the tribunal sitting are exempt as the services are directly linked to the treatment of the person.

4.11 Occupational health

Occupational health services are now provided by individual doctors and a wide range of organisations with varying legal status. It’s a rapidly growing field and a significant proportion of occupational health services have been contracted out by the NHS to commercial bodies.

Broadly speaking, services provided in this field fall into the following categories with the liability as indicated.

Pre-employment medicals

Although now very rarely performed in the light of recent equality legislation, these are taxable supplies as they’re primarily for the purpose of enabling a prospective employer to take a decision on recruitment. This includes medicals (and reports) for the purpose of determining whether a person is medically fit enough to join a professional register.

In most cases medicals now only take place once an applicant has been offered a job and a job offer is made conditional on the results of the medical. Again these medicals are taxable because they’re primarily done so that the employer can make a decision on recruitment.

Sometimes medicals are performed on successful job applicants to help determine the most suitable location for them to work within an organisation. As the medical is done primarily with the health interests of the successful applicants in mind, the employers having already decided to recruit them, these supplies are exempt.

Post-employment medicals

Where these are to make sure a person is medically well enough to undertake proposed work activities, assess whether proposed work could adversely affect their health and to make recommendations to minimise any risk accordingly or determine whether early retirement on ill-health grounds is appropriate, then the principal purpose is protecting the health of the individual concerned and the supply is exempt.

However, where the medical is undertaken to determine whether a person can join a pension scheme, the supply is liable to VAT at the standard rate as the principal purpose is to let a third party to take a decision.

In-service health screening

This service is provided either at an employee’s request or following a management referral. It can also be provided as a result of statutory requirements. Where someone attends on their own initiative, it’s often because they want advice on how a particular health condition affects their performance or about how the work affects their health. Services provided can include checking blood pressure, sugar levels (diabetes) cholesterol and so on. As they’re aimed at protecting, restoring and maintaining the health of the individual, they’re exempt from VAT.

Management referrals are often made because of poor attendance or performance where there are no known underlying health problems. In these cases, the clinic provides advice on how to manage common health problems, provides immediate restorative care, or may consult with the person’s GP, and makes recommendations re referral for physiotherapy, counselling and so on. Whilst this service allows the employer to make a decision with regards to the individual’s future, the underlying purpose of the referral is to deal with the medical problem, and it’s therefore exempt from VAT as it’s undertaken for the purposes of protecting and restoring the health of the individual. (Related reports are considered incidental to the principal supply of health and are therefore also exempt.)

Occupational health providers may also carry out immunisations to protect employees whose work presents particular risk of infection – this is clearly exempt protection of an individual’s health.

Risk assessments including advice on ergonomic layouts

These identify risk in the workplace, quantify it and advise on measures to control it – for example, by issuing protective clothing or changing procedures. Whilst many are undertaken as a result of statutory health and safety requirements, these are generally not undertaken by health professionals in the exercise of their respective professions. As such they’re taxable whether undertaken by a registered or non-registered health professional.

Training and advice

This may qualify as an exempt supply of education, but otherwise essentially represents the occupational health provider’s role in promoting and advising on health issues for the purposes of maintaining the good health of the company’s employees. It’s therefore considered to qualify for exemption as medical care.

4.12 Rehabilitation services

These services are exempt if their principal purpose is to improve both the physical and psychological health of the individual. Reports commissioned for the purpose of determining what is required to assist rehabilitation and recovery, are also exempt. Reports commissioned for the purpose of quantifying the additional costs of disability and hence, the value of any claims for compensation, are liable to VAT at the standard rate.

4.13 Statutory services

Doctors supply a number of services under various statutes. Where no fee is charged, there is no consideration and therefore no supply. Where a fee is charged, but the doctor is compelled by statute to provide the service, it will be outside the scope of VAT. In all other circumstances, the doctor will be making a supply by way of business, which may be taxable or exempt depending on the principal purpose of the supply:

As there’s separate health legislation for England, Wales, Scotland and Northern Ireland, it is not possible to give precise details of all the relevant legislation here, but examples of the type of services covered by statute include:

- registration of deaths – the medical practitioner attending a person during their last illness prior to death must issue the death certificate – no fee is charged for this, so there is no supply

- public health legislation – a medical practitioner who becomes aware that a patient they’re attending is suffering from a notifiable disease or food poisoning must issue a certificate to the local authority, the practitioner is entitled to make a charge for this, but this supply is outside the scope of VAT as the charge is made under statute

- legislation relating to coroners’ services – coroners can appoint a doctor (pathologist) to carry out a post mortem if necessary – if the doctor is compelled to accept this appointment, the charge made for this supply is outside the scope of VAT

- Supreme Court Act 1981 this is where a High Court calls in the aid of a specialist to give evidence of facts, and is relevant to the giving of professional evidence only (see paragraph 4.14) – as the specialist is required to attend when called, the charge made for attending (including any reimbursement of allowances) is outside the scope of VAT

- Blood Test (Evidence of Paternity) Regulations – doctors are not obliged by statute to provide these services (although fees charged are set by statute) – fees charged are therefore consideration for a supply and are taxable at the standard rate

4.14 Witness testimony and allowances

Services of providing professional (giving evidence of facts acquired as a result of your professional position and not covered by the Supreme Court Act 1981) and expert (giving an expert opinion) witness evidence for the courts are liable to VAT at the standard rate as the principal purpose is to let a third party, the court, to take a decision. Allowances paid to doctors to cover their costs whilst appearing in court as a professional or expert witness (including travelling and accommodation costs and reimbursement of a locum’s charges) are regarded as part of the overall payment for the witness’s services and are taxable.

Allowances paid to doctors where they’re called as an ordinary witness are considered to be outside the scope of VAT as in these cases, they’re called as a member of the public, and not in their professional capacity.

5. Exemption for care services performed by suppliers that are not enrolled on a statutory professional register

5.1 Supplying health care if you’re a corporate body

You can supply healthcare provided that your medical services are wholly performed by employees who are health professionals.

5.2 Exemption of care services performed by a person not enrolled on a statutory medical register

Care services can be exempt, but only when the service is health or nursing care that is provided either:

- under the direct supervision of a health professional (other than a pharmacist) who monitors the services through regular checks (see paragraph 5.3)

- or in a hospital or nursing home (see paragraph 5.4)

5.3 Services that are directly supervised

Care services provided by any person who is not a registered health professional, are ‘directly supervised’ for the purposes of the VAT exemption, when all of the following conditions are met:

- the services are supervised by one of the registered health professionals listed in paragraph 2.1 and the supervisor is professionally qualified to perform and supervise the service

- the service requires supervision by a registered health professional, and is provided predominantly to meet the medical needs of a client

- the supervisor has a direct relationship with the staff performing the service, and is contractually responsible for supervising their services

- a qualified supervisor is available for the whole time that the care service is provided

- no more than 2,000 hours per week of staff time are supervised by a single health professional

- a supervisor has a say in the level of care to be provided to the client, and will usually see the client prior to the commencement of the care service

- the supervisor must be able to demonstrate that they monitor the work of the unregistered staff

Where the conditions are not met, your services are standard-rated, even when performed to meet the medical or health care needs of a client.

5.4 Exemption of services of unregistered staff working in a hospital or other state-regulated institution

Medical services performed by unregistered staff may also be VAT exempt when all of the following conditions are met:

- the care service is performed in a hospital, nursing home, hospice, pathology laboratory or other state-regulated health institution (see Health institutions supplies (VAT Notice 701/31))

- the unregistered staff working in a hospital, nursing home, hospice, pathology laboratory or other state-regulated health institution provide care that is directly connected with the welfare of the recipient – this would normally involve the provision of personal care services, but not services such as catering or hairdressing

6. Supplies of health professional staff

This section explains the liability position of supplies of health professional staff. Generally speaking, apart from the nursing agencies’ concession mentioned in paragraph 6.6, all supplies of health professional staff are taxable for VAT purposes.

6.1 Agency or arrangement fees

If you’re an agent, your commission, fee or any other charge that you make for arranging and administering the supply is standard-rated.

6.2 How to decide whether you’re an agent or a principal

This is determined by reference to your contractual and other arrangements. VAT guide (VAT Notice 700) contains further details that may help you decide whether you’re an agent or principal.

6.3 Supplies of registered health professionals (other than nurses) by employment businesses acting as a principal

The Employment Agencies Act 1973 defines an ‘employment business’ as a ‘business (whether or not carried on with a view to profit and whether or not carried on in conjunction with any other business) of supplying persons in the employment of the person carrying on the business, to act for, and under the control of, other persons in any capacity’.

Staff supplied by an employment business may be either employees of that business, or self-employed and engaged by that business. In both cases the workers’ services are provided to the employment business, which in turn makes a supply of that worker to the client. If the worker comes under the direction and control of the client, this is a supply of staff. The employment business in these circumstances is acting as the ‘principal’.

When an employment business supplies registered health professionals (other than staff subject to the nursing agencies’ concession referred to in paragraph 6.6) as a principal to a third party, where the health professional is working under the control and guidance of the third party, it’s making a taxable supply of staff to that third party – not an exempt supply of healthcare. It’s the third party which is responsible for providing healthcare to the final patient, rather than the business supplying the staff which has no such responsibility.

A taxable supply of staff is made even where the employment business is responsible for ensuring that the workers it provides are properly trained and qualified when they work under the control of the third party.

However, if the employment business maintains the direction and control of its health professional staff to make a supply of medical care directly to a final consumer, then the employment business is providing medical services rather than merely a supply of staff. In these circumstances, the business is making an exempt supply of health services (provided, of course, the services meet the conditions for exemption under paragraph 2.3).

6.4 Deputising Services

The health and welfare exemption include supplies of deputising services where the provider takes direct responsibility for medical care. The relevant Clinical Commissioning Group is responsible for ensuring that there is out-of-hours cover. GPs can contract with a commercial deputising entity to perform their out-of-hours duties. Where this service is provided by registered doctors or nurses, who provide medical advice or care, then the exemption applies. The main out-of-hours calls are channelled through to the NHS 111 service, although they could be outsourced elsewhere. The exemption does not apply where non-medical advice is given or when advice is given by a person who is not a medical professional, unless they are supervised by a medical professional for example, call centre staff working from a crib sheet of standard questions to filter out calls and only advising people to contact a doctor or dial 999 for an ambulance.

6.5 Supplies of self-employed locum doctors including GPs

The services of a locum are different to the deputising service described above. Where a locum doctor is supplied by an employment business or similar body to a third party (like a GP Practice) which controls and directs him or her, it is a supply of staff. Supplies of staff do not fall within the exemption and are therefore taxable, with VAT being charged at the standard-rate. When a self-employed locum supplies their services to an employment business (including via a Personal Services Company) which in turn makes an onward supply to third party, who is legally responsible for providing healthcare to the final patient, both the supply to the employment business and the supply by the employment business to the third party are taxable.

The fact that the locum may not be supervised by any medical staff of the third party does not mean that the employment business supplying the locum doctor is legally responsible for providing healthcare to the final patient.

6.6 Supplies of nurses, nursing auxiliaries and care assistants by state regulated agencies (the nursing agencies’ concession)

By an informal extra-statutory concession, nursing agencies (or employment businesses that provide nurses and midwives, as well as other health professionals) may exempt the supply of nursing staff and nursing auxiliaries supplied as a principal to a third party, if the supply is of:

- a person registered in the register of qualified nurses and midwives maintained under article 5 of the Nursing and Midwifery Order 2001 providing medical care to the final patient

- an unregistered nursing auxiliary who is ‘directly supervised’ by one of the above

- an unregistered nursing auxiliary, whose services are supplied to a hospital (NHS or private), hospice, care home with nursing under item 4 of Group 7, Schedule 9 VAT Act 1994 and form part of the care made to the patient

A nursing auxiliary (also known as a healthcare assistant) is an individual who is not enrolled on any register of medical or health professionals but whose duties must include the provision of medical, as well as personal, care to patients.

This does not apply to umbrella companies supplying services of staff to a recruitment agency. It only applies to the direct provision of staff. For example nurses and nursing auxiliaries to a health provider by a business acting as a principal.

The Court of Appeal recently confirmed in the case of First Alternative Staffing Ltd and another that the concession was only available prospectively. It also cannot apply where input tax is recovered by the supplier on related costs because that is not consistent with exemption.

The institution to which staff are supplied may be operated by a local authority, NHS body, charity or other organisation operating in the public or private sector.

To qualify for the concession, the employment business must be registered with one of the following organisations:

- Scottish Commission for the Regulation of Care

- Care Standards Inspectorate for Wales

- Northern Ireland Health and Personal Social Services Regulation and Improvement Authority

- Care Quality Commission (for supplies before 1 October 2010)

In England, with effect from 1 October 2010 (as a result of changes announced in the Health and Social Care Act 2008), it is no longer a legal requirement for employment businesses involved in the supply of nurses to be registered with the Care Quality Commission.

For the supply of nursing auxiliaries or care assistants to benefit from the concession, they must undertake some direct form of medical care, such as administering drugs or taking blood pressures, for the final patient. The concession does not apply to supplies of general care assistants who are:

- only involved in providing personal care such as catering, washing or dressing the patients

- working in care homes without nursing where they do not require supervision by health professionals to provide their services

However, where a state-regulated domiciliary care agency supplies the services of its care assistants directly to the final patient, we would see the agency as making an exempt supply of welfare services – see Welfare services and goods (VAT Notice 701/2).

HMRC regularly reviews Extra Statutory Concessions.

6.7 The wording of terms and conditions of agreements

Some employment businesses state in their contract terms that their staff are still working under their control and direction rather than the third party to which their staff are being supplied. If that is the case, you are not acting as an ‘employment business’ within the definition of the Employment Agencies Act 1973. The VAT liability of a supply is not determined conclusively by the terms of any contract or other documentation alone. If the wording of a contract does not reflect any changes in the way that the business actually operates in practice, the VAT liability of a taxable supply of staff will not change.

6.8 Supplies of contracted-out health services

Employment businesses in the health sector make a taxable supply of staff to third parties, such as hospitals or hospices, if the third party is legally responsible for the onward supply of providing care to the final recipient. This is subject to the nursing agencies’ concession. The fact that an employment business is state regulated does not mean that its supplies of staff are exempt if they are not covered by the nursing agencies’ concession.

However, when state-regulated health providers provide health services to the final consumer, these services remain exempt even if they’re contracted out and paid for by a hospital or other third party. For example, a NHS hospital may subcontract the provision of medical care to a separate clinic providing dialysis treatment. Although the NHS trust may pay the clinic for its services, this does not mean that the clinic has made a supply of staff to the NHS. This is because the clinic’s staff will still be working under the direction and control of the clinic itself throughout the provision of the services rather than under the hospital trust.

7. GPs

7.1 Other NHS income

GP practices receive a monthly Statement of Fees of NHS payments due to the practice. All of these payments (other than accounting or timing adjustments) are consideration for the practice’s supplies of medical services.

Payments will be liable to VAT depending on their principal purpose and according to the principles and guidance outlined in section 2 and section 4.

Payments relating to activities where the principal purpose is the protection, maintenance or restoration of the health of the patient (for example, anti-coagulant monitoring, childhood immunisations, flu and pneumococcal vaccinations) are payments for exempt supplies.

Payments in relation to services such as the completion of forms to let persons to obtain blue or orange disability badges are liable to VAT at the standard rate.

‘General’ payments and reimbursements of practice costs (for example, GMS global sum, Minimum Practice Income Guarantee correction factor, computer costs, notional rent) are also payments directly related to exempt services unless the practice has dispensing activity, in which case they will cover taxable and exempt supplies. In these cases, they will need to be apportioned in accordance with the guidance given in VAT guide (VAT Notice 700) on apportionment.

7.2 NHS payments to doctors for drugs and appliances

You will also receive reimbursement from the NHS for any drugs and appliances that you have dispensed or administered to patients. If you’re a doctor authorised to provide NHS pharmaceutical services, this payment will consist of:

- a taxable element – that part of the payment which relates to items you have dispensed to a patient under NHS pharmaceutical regulations, and to supplies of oxygen

- an exempt element – that part of the payment which relates to drugs or appliances you have administered to a patient

Paragraph 7.3 explains how you should calculate what proportion of this reimbursement is taxable.

7.3 Calculating how much of your NHS payment for drugs and appliances is taxable if you’re a dispensing doctor

Dispensing doctors receive 2 statements from the NHS, 1 relating to dispensed drugs and the other to their supply of medical services. To determine the value of exempt supplies from the drug statement HMRC considers that, whilst not being entirely accurate, the net value of the VAT allowance can be used as a proxy for the exempt supplies of drugs. If you wish to determine exempt values more accurately you may, provided that the method used is not arbitrary and can be audited by officers of HMRC. An apportionment of the dispensing fees figure will also need to be made. VAT guide (VAT Notice 700) gives details on acceptable apportionment methods.

7.4 VAT liability of goods supplied to patients by a doctor

If you’re a doctor who’s authorised to provide NHS pharmaceutical services to certain patients, (see paragraph 3.2.3) the payments you receive from the NHS for items dispensed to those patients are zero-rated, provided that the items are:

- dispensed to the patient on the basis of an NHS prescription

- taken away from the surgery

- supplied for the personal use of the patient

NHS payments received in respect of the drugs or appliances that you have personally administered, injected or applied to a patient in the course of medical treatment are exempt, even if you’re authorised to provide NHS pharmaceutical services.

VAT may be due on any other items that you supply to patients (see section 3) including medicines dispensed by a doctor against a private prescription.

8. VAT-registered health professionals and VAT recovery

8.1 Recovering VAT if you’re a health professional

If you’re a VAT-registered health professional, you’re entitled to deduct the input tax incurred on costs that you use or intend to use in making taxable supplies. You may reclaim the VAT that you have paid on any purchases that are directly attributable to your taxable (standard or zero-rated) supplies. This will include drugs and medicines purchased by doctors for supply to patients under NHS pharmaceutical arrangements.

However, you cannot normally deduct input tax that relates to your exempt supplies. This includes VAT incurred on the drugs or appliances that doctors have personally administered, injected or applied to their patients in the course of medical treatment.

If your input tax relates to both taxable and exempt supplies – which can often be the case with business or surgery overheads such as utility charges or purchases of items of medical equipment – this is known as residual or non-attributable input tax. You can normally deduct only the amount of this that relates to your taxable supplies.

VAT incurred in respect of non-business activities, such as statutory work, is not input tax and cannot be recovered.

8.2 How to work out how much VAT you can recover if you’re a health professional

If you’re a VAT-registered health professional making both taxable and exempt supplies, you’re partly exempt for VAT purposes. Partial exemption (VAT Notice 706) explains how partly exempt traders should calculate how much of the VAT incurred on business overheads and purchases may be recovered. As part of that calculation, you’re required to distinguish between:

- supplies and purchases that relate to taxable (standard or zero-rated) activity, for example services not aimed at the protection, maintenance or restoration of health, or NHS pharmaceutical services provided by doctors

- supplies and purchases that relate to exempt activity, such as the services detailed in paragraph 2.3 or the administration of drugs in the course of medical treatment

- supplies and purchases that relate to both taxable (standard and zero-rated) and exempt activity, such as overheads

You should work out which of your supplies are taxable and which are exempt with reference to the liability rules detailed elsewhere in this notice.

8.3 Dispensing doctors

Although the amounts shown on the statements received from the NHS relate to supplies made 2 or 3 months earlier, it’s been agreed that the values to be used in the standard partial exemption method will be the amounts shown on the statements or payments received in the period (see paragraph 7.3 for determining exempt and taxable values).

9. Medical practitioners visiting the UK

9.1 Exemption of services if you’re a medical practitioner from an EU member state

If you’re a national of any European Economic Area (EEA) State, are lawfully established in medical practice in an EEA State other than the UK and you’re visiting the UK to provide medical services temporarily, you will be required to register in the register of medical practitioners as a visiting EEA practitioner before you can exempt your supplies.

In an urgent case a medical practitioner from an EEA State may not be in a position to register in the register for medical practitioners prior to visiting the UK and providing services, for example, where a visitor to the UK is taken ill and wishes to be treated by his own doctor. You can exempt your supply in such circumstances provided you seek registration as a visiting practitioner, usually no longer than 15 days after the service has been performed.

10. Dentists, dental care professions and dental technicians

10.1 Liability of services and goods

If you’re a dentist, a dental care professional or a dental technician you may exempt your supplies of:

- dental care and treatment

- drugs or appliances provided in the course of dental care and treatment

- dental prostheses (including dentures, artificial teeth, crowns, bridges, plates and other orthodontic appliances)

The exemption applies whether or not you provide your services privately or on the NHS. Items, other than prostheses, that are separable from dental treatment provided to a patient will usually be standard-rated. This includes any supply of toothbrushes, toothpaste and dental floss.

Advisory services, for example, advising on clinical governance, poor performance and standards – as supplied by a small number of dentists to Clinical Commissioning Groups on a self-employed basis are generally also standard-rated. Where such services are provided on an employee (not self-employed) basis, any income received will be outside the scope of VAT.

Cosmetic dentistry services will need to be considered on a case by case basis and will be exempt only where they’re supplied as an element of oral health treatment by a registered health professional, as part of a health care treatment programme. For services undertaken by hospitals and state-regulated institutions, see Health institutions supplies (VAT Notice 701/31).

10.2 Supplies between dentists within the same practice

A dental practice is often comprised of a number of dentists operating from the same premises. When there’s more than one dentist within a practice there may be payments between the dentists in respect of shared facilities, equipment, prostheses and staff. Such charges are exempt provided that they relate to services or facilities that are:

- predominantly medical in nature

- necessary to allow the recipient to perform dentistry

This exemption does not apply to:

- any supplies made by a dentist who has ceased to practise, or by a landlord who is not a dentist

- supplies of goods (other than dental prostheses) that are held out for sale to patients, such as toothpaste and toothbrushes

- any sales of dental equipment by a practice owner

11. Pharmacists

The framework for community pharmacy services came into effect from 1 April 2005 in England and Wales and required pharmacies to provide the services detailed in paragraphs 11.2 to 11.8 from 1 October 2005 onwards.

The Scottish contractual framework (which is different from the English and Welsh one) was introduced on 1 April 2006 – see paragraph 11.9. The Northern Irish framework is still being negotiated. Separate guidance will be provided in respect of these arrangements, if required, in due course.

11.2 Services provided by pharmacies

Pharmacy services fall into 3 categories:

- essential

- advanced

- enhanced

All pharmacies provide essential services; some may also provide advanced and enhanced services, depending on the terms of their contracts with Clinical Commissioning Groups.

11.3 Essential services

Essential services comprise dispensing and repeat dispensing, disposal of unwanted medicines, signposting, promotion of healthy lifestyles, support for self care, and support for people with disabilities.

11.4 VAT liability of essential services

11.4.1 Dispensing and repeat dispensing

Where dispensing or repeat dispensing is undertaken by a registered pharmacist, against a prescription issued under all the conditions described in paragraph 3.2 the pharmacists are making a zero-rated supply of goods.

There are a number of payments which relate to the dispensing activity. These are:

- item fee

- establishment payment

- protected payment

- repeat dispensing annual payment

- transitional payment

- special fees for dispensing controlled or expensive drugs and for measuring and fitting appliances that the pharmacy also customises

All of these payments are consideration for dispensed goods and zero-rated where the conditions for zero rating are met.

11.4.2 Disposal of unwanted medicines

This service involves taking in unwanted medicines, sorting and storing them until the appropriate health authority arranges for them to be collected and destroyed. It’s a standard-rated supply.

11.4.3 Signposting

This activity provides patients with information about other, non-pharmaceutical services which might be beneficial to them. The service does not need to be performed by a registered pharmacist and is standard-rated.

11.4.4 Promotion of healthy lifestyles

This is one service comprising of 2 stages, the provision of information by means of leaflets and poster displays and individually tailored advice given by the pharmacist to patients in certain identified at-risk groups. The latter element is the predominant one and is aimed at the maintenance of a person’s health. Accordingly, this service is exempt.

11.4.5 Support for self-care

This involves providing patients with pharmaceutical advice about medicines and other products available over-the-counter. The pharmacist’s provision of advice will be exempt. Any medicines sold over-the-counter will be a separate, standard-rated supply.

11.4.6 Support for people with disabilities

This is extra support provided to patients in response to their assessed need, in order to facilitate their safe self-administration of medicines. This support is a requirement under the Disability Discrimination Act 1995 and can comprise:

- special labelling of containers for use by visually disabled patients

- removing drugs from blister packs and repackaging them in replacement containers such as multi-compartment boxes

- reminder charts

This activity is a further aspect of the dispensing of prescribed medicines and is zero-rated where the medicines themselves are zero-rated.

11.5 ‘Practice payment’ and apportionment

All of the supplies under paragraphs 11.4.2 to 11.4.6 are covered by the ‘practice payment’. This payment also covers ‘clinical governance’, in this instance, an element of its funds and the professional delivery of NHS pharmacy services. Clinical governance is not a supply for VAT purposes and this funding is outside the scope.

The practice payment is therefore made up of 6 elements, 2 of which are standard-rated, 2 exempt, 1 zero-rated and 1 outside the scope. You will need to apportion it between these elements in order to calculate your taxable and exempt supplies and any output tax due. Information on the percentage weighting to be applied to each element is available from the Pharmaceutical Services Negotiating Committee.

11.6 Advanced services and their VAT liability

The medicines under review and prescription intervention are advanced services. These involve reviewing a patient’s needs for and use of medicines, including whether the patient is experiencing any side effects or other problems. These services are exempt.

11.7 Enhanced services

Clinical Commissioning Groups and local Health Boards in Scotland can also contract with pharmacies to deliver other, local enhanced services. General advice on the most commonly encountered services is set out below. However, these arrangements are tailored to meet local needs and so the actual contractual terms can be subject to variation.

In deciding the correct liability of your supplies you will need to examine the particular arrangements you have entered into, bearing in mind the single or multiple supply rules and taking account of the status of the person performing the service. Contact the VAT: general enquiries helpline for more information on single or multiple supply rules.

11.7.1 Needle and syringe exchange

Typically, this service may involve making clean needles and syringes available free of charge to drug users and diabetics, disposing of used needles safely and providing health education advice and information to service users.

Sterile needles and other materials are often provided free of charge to users by the Clinical Commissioning Group or local Health Board via the pharmacy. Accordingly, the free issue of these goods is not subject to VAT.

The service will be an exempt supply where a registered pharmacist:

- assesses the condition of service users and, where appropriate, provides 1-to-1 health advice or treatment

- provides 1-to-1 advice to service users about safe injecting techniques

- where appropriate, provides 1-to-1 advice on dealing with injecting or drug related infections and illnesses

The pharmacist does not need to provide these services to every service user for VAT exemption to apply. However, we would expect the contract to require these services to be provided to service users on request, or where considered appropriate by the pharmacist.

The service will be standard-rated where the:

- pharmacist is merely issuing new needles and overseeing the surrender of old ones and has no role in assessing the health condition of the service user

- service does not require the skills and experience of a pharmacist and is such that it could be, or is, carried out by a pharmacy assistant or any other member of staff who is not a registered pharmacist

- pharmacist’s provision of health education or information goes no further than issuing standard leaflets to service users

11.7.2 Minor ailment service

Under this service pharmacies provide support to eligible patients presenting with a minor ailment such as conjunctivitis or diarrhoea. Following assessment, the pharmacist might give advice, supply appropriate over-the-counter medicines or dressings to treat the ailment or refer the patient to another health professional. In providing the service the pharmacy works to guidelines set out in a local protocol which will define the groups of persons eligible to receive treatment and the formulary from which medicines may be issued.

Where assessment of the patient’s condition and the provision of advice and support in managing the ailment are carried out by a pharmacist, this is an exempt service. But any medicines or dressings issued will be standard-rated where they constitute separate supplies of goods. Payment for the goods is made by the NHS rather than the patient.

11.7.3 Patient Group Directions

These directions are drawn up locally. They permit pharmacists to issue defined drugs to a class of patients presenting with particular conditions. Patient Group Directions do not amount to ‘prescriptions’ because they are not written in respect of an identified, individual patient so the supply of goods will be taxable at the standard rate.

Contractors requiring assistance in determining the liability of their enhanced services should contact the helpline.

11.8 Other payments received by pharmacists

11.8.1 Electronic Prescription Service

Electronic Prescription Service (EPS) lets prescribers send and dispensers receive prescriptions electronically (drugs and medicines are dispensed against electronic rather than paper prescriptions). In order to use the EPS, a contractor needs to comply with the requirements for the EPS system.

EPS is being deployed with 2 releases of software (release 1 and release 2). Contractors will receive 2 fees as a contribution for implementing release 1 and 1 fee for implementing release 2. These fees reflect pharmacies having the right information technology and software systems in place.

Once a contractor is in a position to use either release 1 or release 2 they can claim an ongoing monthly fee to contribute to connectivity and information technology maintenance costs.

None of these fees are consideration for supplies made. They’re funding to support EPS and accordingly are outside the scope of VAT.

11.8.2 Prescription charge refunds

Sometimes patients who are exempt from paying NHS prescription charges need to obtain prescription medicines before they have received the certificate that confirms their status. In these circumstances they pay the prescription charge when their medicines are dispensed but claim it back at a later date, once they hold the necessary documentation.

Under the contractual framework for community pharmacy, pharmacies will be responsible for making these refunds, but there is no clearly distinguishable payment for this activity. It does not amount to a supply for VAT purposes.

11.8.3 Exit payments

During the first year of the contractual framework, any pharmacy dispensing less than 2,000 items per month, and which decides to close, will receive a one-off payment equal to the amount it would have received under the Professional Allowance (an allowance paid under previous funding arrangements), had it remained open for a further year. This payment is not consideration for any supply made by the pharmacy and is outside the scope of VAT.

11.9 Contractual framework for community pharmacy services (Scotland)

The Scottish Contractual Framework was introduced on 1 April 2006. The new Scottish Contractual Framework’s structure is different from its English and Welsh equivalent. Rather than differing levels of service it has 4 distinct core components:

- Acute Medication Service (AMS) – this is essentially the dispensing of prescriptions – see section 3

- Minor Ailments Service (MAS) – see paragraph 11.7.2

- Chronic Medication Service (CMS) – this allows a pharmacist to manage a patient’s long-term medication for up to 12 months, a patient can have their medicines provided, monitored, reviewed and, in some cases, adjusted as part of a shared care agreement between the patient, GP and community pharmacist – patients have to register with a pharmacy – see section 3

- Public Health Service (PHS) – pharmacies are able to provide information in public health issues and create public health window displays, they are expected to participate in national and local public health campaigns, payment for this service is a fixed fee – see paragraph 4.5 on health education services

Although the new contract officially started in April 2006, implementation was phased. MAS and PHS began from July 2006, AMS from April 2008 and CMS from April 2009. On top of the core contract pharmacists are also able to provide additional services similar to the enhanced service level of the English and Welsh contract (see paragraph 11.6) as part of their business, making community pharmacies more viable in smaller communities.

Your rights and obligations

Read Your Charter to find out what you can expect from HMRC and what we expect from you.

Help us improve this notice

If you have any feedback about this notice, email: customerexperience.indirecttaxes@hmrc.gsi.gov.uk.

You’ll need to include the full title of this notice. Do not include any personal or financial information like your VAT number.

If you need general help with this notice or have another VAT question you should phone our VAT helpline or make a VAT enquiry online.

Putting things right

If you’re unhappy with HMRC’s service, contact the person or office you’ve been dealing with and they’ll try to put things right.

If you’re still unhappy, find out how to complain to HMRC.